Sync Contact Data on Open and Close

When you open or close a tax return, ATX syncs with CCH iFirm, recognizing changes to contact data. The following data is exchanged between ATX and CCH iFirm:

- SSN or TIN

- Taxpayer name or business name

- Address, city, state, and zip code

- Work, cell and home phone numbers

- Email address

- Date of birth

- Date of death

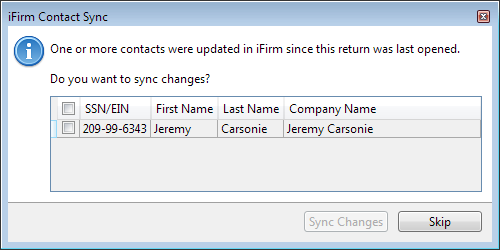

When you open a return if there are any changes from CCH iFirm, ATX recognizes these changes and prompts you to sync the changes.

To sync updated contact information from CCH iFirm when opening a return:

- Open your return. For more information see Opening Returns. When changes have been made to the contact in CCH iFirm, a dialog appears asking if you want to sync:

CCH iFirm Contact Sync dialog box

- Select the check box for the contact(s) you want to sync.

- Click Sync Changes.

If you want to keep the current information in ATX, click Skip.

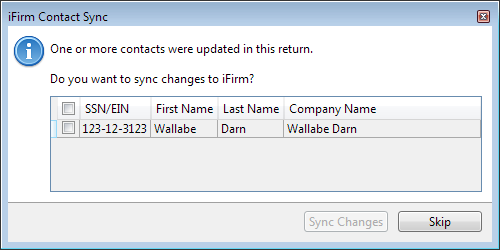

Similarly, when you close a return, if there are supported field changes, ATX asks you if you want to sync the changes to iFirm.

To sync updated contact information from ATX to CCH iFirm when closing a return:

- In ATX, save and close your return. For more information, see Closing Returns.

- When changes have been made to the contact in ATX, a dialog appears asking if you want to sync:

CCH iFirm Contact Sync dialog box

- Select the check box for the contact(s) you want to sync.

- Click Sync Changes.

If you want to keep the current information in CCH iFirm click Skip.

See Also: